Slightly more than four decades

ago, two academics from University Kebangsaan Malaysia published a paper on the

savings rate in Peninsular Malaysia. Drawing from Department of Statistics

(DOS) 1957 Household Budget Survey - the last survey undertaken by the colonial government, they found out that on average, Malaysian

households saved about $19.47 per month, which translated to a savings rate of

nearly 10% of monthly income. Interestingly, they also found out that urban

households saved more - 11% of income compared to rural households (8%), and

Malay households had a higher propensity to save compared to other groups - on

average, Malay households saved 13% of their monthly income compared to 8% in

the case of Chinese households.

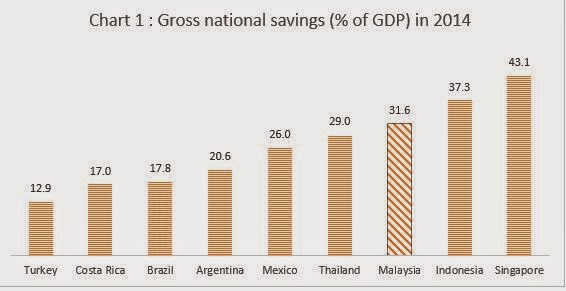

Unfortunately, there has not been a study or publication on the pattern of savings among Malaysian households since then. We are thus unable to know whether Malaysians save more or less, and the dynamics of our savings behaviour. What is regularly published is our national savings rate. Latest figures from the International Monetary Fund (IMF) show that Malaysia’s gross national savings, as a percentage of GDP, is 31.6% in 2014, which is higher than the rate charted in other higher middle income countries (Chart 1).

Source: IMF (2014)

Does a high national savings rate

mean that our households also have a high savings rate? The answer is

unfortunately, no. The United Nations

Development Program recently released a report, “Malaysia Human Development Report

[MHDR] 2013 – Redesigning an Inclusive Future,” highlighted the vulnerabilities

of Malaysian households primarily due to a lack of savings. Using data from successive Household Income

Surveys, the report stated that about 88% of Malaysian households reported zero

earnings from precautionary savings [excluding EPF deductions which are known

as compulsory savings]. The report further stated that financial investment

among Malaysians is also quite low – about 57% of Malaysian households reported

zero earnings from investment. The lack of investment is more pronounced among

urban households compared to rural households. On average, 50% of urban

households have no investment, compared to 34% of rural households. There are no differences in the savings rate

among ethnic groups. According to the MHDR “[R]oughly

one out of two Bumiputera, Chinese, and Indians have no immediate liquid

financial assets, making them vulnerable in the event of an income or

employment shock”. Even the figures

for compulsory savings i.e. savings in EPF, paint an equally perturbing

picture. Using EPF data, the MHDR shows that as at 2013, roughly a fifth of

Malaysians who are nearing retirement age have less than RM 20,000 in savings.

Why is this so? Is it because of

lack of financial inclusion? Not necessarily. Data from Bank Negara Malaysia

show that nearly 92% of Malaysians have savings or deposit accounts, which

means that access to basic savings instruments is not an issue. However, when

one looks at investment accounts, different pictures emerge. For instance, half

of the Bumiputera do not have an ASB account, and about two-thirds do not have

accounts with Tabung Haji. The key reason why many Malaysian have low savings

and low financial assets is due to low incomes and salaries. Based on data from

DOS, median monthly salaries and wages per month in 2013 is RM 1,700. This is

not surprising, as only 10.4% of Malaysian workers are degree-holders. Given

the low wages and high cost of living, it is no surprise that many Malaysians

find it hard to set aside some money for savings and investment.

While there are many short-term

measures that can be implemented to alleviate financial constraints of

households, what we need are long-term and sustainable solutions. Khazanah

Research Institute’s inaugural publication “The State of Households” published

early last month aptly describes the solution. A focus on education is a must

as “[A] lack of education of the

overwhelming majority of our workforce is one of the most important causes of our

low wages and low household incomes”. Education in this sense is not only

about acquiring higher educational attainment but equally important is to

ensure financial literacy and awareness, especially among the younger

generations. To reap the benefits of the country’s development in an equitable

and empowering manner, it is essential to adhere to the popular saying that an

investment in education pays the best interest.

by Muhammed Abdul Khalid

[Note : Originally published in Malaysian Business 16 Dec 2014]

No comments:

Post a Comment